Disaster Recovery Adjusters. Experts in assisting property owners in the insurance claims process.

Would you go to court without legal representation? How about running a business without an accountant?

Recovering from a disaster alone can lead to physical, mental, and emotional exhaustion. Now, try interpreting a complex insurance policy, coverage issues, and the burden to prove every detail of your loss to the insurance company. Dealing with destruction to your property from a disaster is not something you can take on alone.

There are three types of “adjusters” who you may interact with over the course of the claim.

Public Insurance Claims Adjusters are by law, experts who work exclusively for the policyholder and never for the insurance company. Following a disaster, Public Insurance Claims Adjusters prepare detailed scope and cost estimates many times using experts to prove the loss. Public Insurance Claims Adjusters also review and interpret the insurance policy to determine covered and uncovered items and to negotiate with the insurance company to a final and fair settlement.

What to Expect

Conduct a complimentary phone interview to assess your claim’s potential. If you’re a fit for our services, we will explain and review our NO MONEY upfront fee agreement with you and schedule a FREE onsite consultation.

After we conduct an onsite inspection, we will review any existing documents, including your policy for endorsements and additional coverage.

We contact your insurance company to file the claim on your behalf. We will schedule the initial onsite inspection with them. If it is an established claim, we will discuss with your insurance company what documentation and actions are needed by them.

Once the insurance company clears coverage and evaluates the damages, we will review the documentation provided by the insurance company to determine what, if anything, has been overlooked or underpaid for a fair settlement. We will provide selected reports and documentation at our expense if needed, to negotiate additional payments for a successful Disaster Recovery Adjustment.

Many people don’t realize that the insurance company doesn’t automatically pay their insurance claim. Instead, the burden lies with you to prove the claim to be compensated for a loss. When a disaster strikes, the insurance company has adjusters, building engineers, claims managers, and supervisors all representing their interests. Who do you have representing yours?

There are many different forms of insurance policies, coverages, and endorsements that differ greatly between insurance companies. Knowing what is included and excluded within your policy is key to understanding what is covered and not covered when it comes to recovery.

Engagement of a Public Insurance Claims Adjuster soon following a disaster is not only economical but vital. The actions immediately following a disaster to document the damage and begin the negotiation process with the insurance company is critical to determining a fair and final settlement.

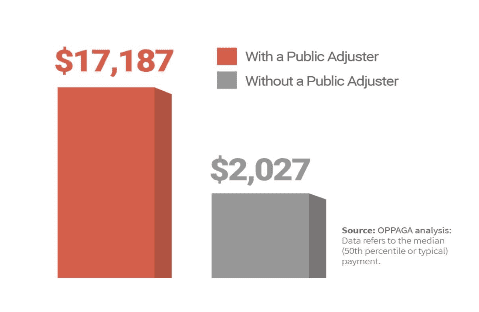

Public Insurance Claims Adjusters get higher payouts (on average) for policyholders than they get on their own. A study conducted by OPPAGA (Office of Program Policy Analysis & Government Accountability) proved this when looking over one insurance company’s claims. When a policyholder files a claim on their own, they received a payout of about $2,029.00. When they used a Public Adjuster the claim payout, on the same claim, was around $17,187.00. See full OPPAGA report here.

Disaster Recovery Adjusters also has a 24/7 Emergency Services for board-up or water cleanup. For further information please call our main office at 814-882-7797.

Get In Touch

24/7 Support

We’re available 24/7 to answer your questions about the insurance claims process. You can reach us by telephone or email.

Call Us

You can reach us any time, at:

Erie, PA

(814) 882-7797

Pittsburgh, PA

(412) 996-9117

Cleveland, OH

(216) 353-4704

Centreville, VA

(571) 771-8917

Email Us

Rapid response, via Jeremy@DRA-LLC.com